Value-add investments have emerged as a compelling option for investors seeking to maximise returns in a challenging market environment. This increased appeal stems from a confluence of factors that have fundamentally altered the real estate landscape.

Firstly, tighter yield spreads have nudged investors towards higher-risk opportunities that offer the potential for greater returns. Simultaneously, a prolonged period of underinvestment in new assets has coincided with growing occupier demand for high-quality, sustainable spaces that can attract and retain both employees and customers.

This trend is particularly pronounced in the office sector, where a growing divide between obsolete buildings and premium spaces has created significant opportunities for value-add investments. The increasing importance of sustainability goals and mandatory compliance with stock market regulations has fuelled sustained demand for ESG-compliant precincts, further widening this gap.

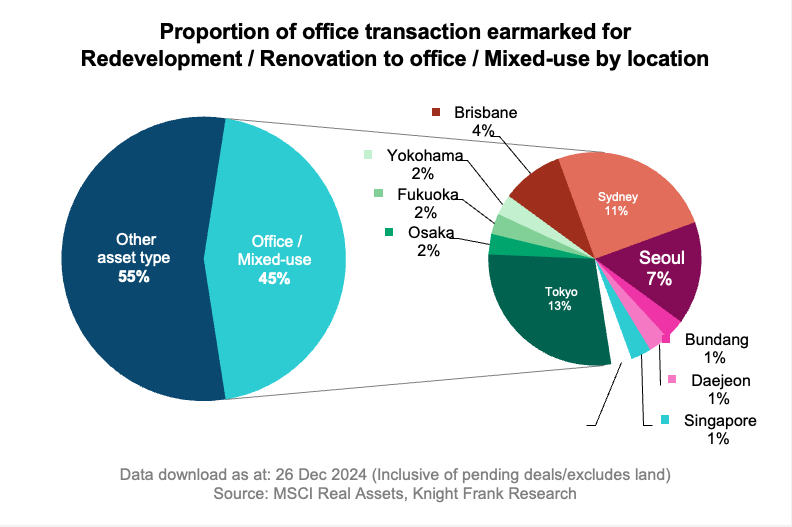

An analysis of the MSCI Real Asset database reveals a telling trend: nearly 45% of office buildings transacted in 2024 with the intention of redevelopment or renovation are slated for conversion into offices or mixed-use developments with an office component. This represents an increase from 41% in 2023, underscoring the growing appetite for value-add opportunities in the office sector.

A two-tiered market emerges

The demand for modern, sustainable office spaces has led to the emergence of a two-tiered market. This dynamic creates a unique opportunity for value-add investors to acquire and upgrade older properties, bringing them up to modern standards and appealing to quality tenants.

Cities with a larger stock of older buildings that are less accessible or lack modern amenities, such as Tokyo and certain Australian cities, present particularly attractive value-add opportunities. In these markets, investors can leverage their expertise to transform outdated assets into sought-after, ESG-compliant spaces that command premium rents and attract high-quality tenants.

Beyond traditional property types: the appeal of defensive sectors

As investors seek to meet their return targets in a challenging market environment, interest in alternative assets has grown significantly. Defensive sectors with substantial growth potential have become increasingly attractive, offering resilience and stability against macroeconomic fluctuations.

Data centres have emerged as a standout alternative asset class. Consistently ranked first in terms of prospects for niche property types, data centres secured US$6.3 billion in investments in 2024, excluding the AirTrunk takeover. This represents a remarkable 2.5-fold increase from 2023's US$2.5 billion, highlighting the sector's growing appeal.

The living sectors: capitalising demographic shifts

Another prominent defensive asset class gaining traction is the living sectors. These investments capitalise demographic shifts characterised by a rise in international students, strong population dynamics, and an ageing society, collectively generating an urgent need for housing and specialised facilities.

Unlike mature Western markets, the Asia-Pacific region is currently experiencing a profound structural undersupply in the living sectors, presenting an attractive opportunity for well-funded investors to allocate substantial capital.

Australia's Built-to-Rent (BTR) sector continues to attract significant attention from investors. According to a 2024 ANREV survey of global investors in the Asia-Pacific region, 85% of respondents are now targeting this market, up from 78% in 2021. The BTR pipeline has expanded considerably, with a record high of 4,419 apartments estimated for completion in 2024 and nearly 6,000 units expected in 2025.

While the sector has faced feasibility challenges, including elevated construction costs, labour shortages, and high funding costs, the recent passage of the BTR bill through parliament has improved the outlook for the sector. The growth of BTR is likely to be spearheaded by core offshore investors with a lower cost of capital and specialized expertise in living sectors, such as major European and Canadian investors.

For more insights, please download the latest edition of Knight Frank’s Asia-Pacific Outlook series, Charting New Horizons: 25 Trends Shaping 2025, report below.