In the ever-evolving landscape of real estate investment in Asia-Pacific, data centres have continued to be a beacon of opportunity. As traditional property types face challenges, investors are increasingly turning to defensive sectors that offer resilience against macroeconomic fluctuations and significant growth potential. Among these, data centres stand out as a prime example of how technology-driven demand is reshaping the real estate market.

A sector on the rise

The appetite for data centre investments has shown remarkable growth in recent years, defying broader market headwinds. In 2024, the sector secured an impressive US$6.3 billion in investments, excluding the AirTrunk takeover. This represents a 2.5-fold increase from the US$2.5 billion invested in 2023, underscoring the sector's strong growth trajectory, with the advancement of technologies such as artificial intelligence (AI), the Internet of Things (IoT), and cloud computing. As these technologies become increasingly integral to business operations and daily life, the demand for data processing and storage capabilities has skyrocketed.

Supply-demand imbalance creates opportunities

Despite significant growth in live supply from 2018 to 2023, with a compound annual growth rate (CAGR) of 19.1% as reported by DC Byte, the current data centre capacity in Asia-Pacific remains insufficient to meet the region's massive population demands. When compared with Europe and North America on a per MW basis, the disparity becomes even more apparent, highlighting a substantial imbalance between supply and demand.

This gap presents unprecedented investment opportunities within the digital infrastructure sector across the region. Investors looking to capitalise on this growth potential can explore various avenues within the diverse Asia-Pacific market.

Emerging markets in Southeast Asia

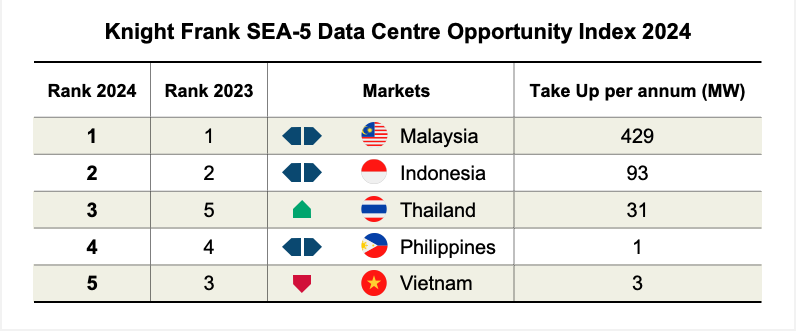

The rise of data centres has been particularly pronounced in the Southeast Asia-5 (SEA-5) markets, comprising Malaysia, Thailand, Vietnam, Indonesia, and the Philippines. This growth has been further accelerated following the 2019 Singapore data centre moratorium, which redirected investment to neighbouring countries.

Leading the pack is Malaysia, which has maintained its position as the premier data centre hub in our Knight Frank SEA-5 Data Centre Opportunity Index 2024. The country's strategic location, robust infrastructure, and supportive government policies have made it an attractive destination for data centre investments.

Other emerging markets in the region include Chennai, Manila, Melbourne, and Bangkok. These cities are rapidly developing their digital infrastructure capabilities, attracting both domestic and international investors looking to tap into the growing demand for data services.

Looking ahead: the future of data Centres in Asia-Pacific

The outlook for data centre investments in Asia-Pacific remains exceptionally bright. The region's rapid digital transformation, coupled with its large and increasingly tech-savvy population, will continue to drive demand for data processing and storage capabilities.

Moreover, the ongoing shift towards edge computing and the rollout of 5G networks are likely to create new opportunities for smaller, more distributed data centres across the region. This trend could open up investment possibilities in secondary markets and create a more diverse data centre landscape.

However, investors must also be mindful of the challenges facing the sector. These include increasing scrutiny of data centres' environmental impact, particularly their energy consumption and carbon footprint. Sustainable design and operation will become increasingly important factors in the success of data centre investments.

Additionally, regulatory environments across different countries in the region continue to evolve, with data sovereignty and cybersecurity concerns shaping policy decisions. Investors will need to stay ahead of these developments and adapt their strategies accordingly.

For more insights, please download the latest edition of Knight Frank’s Asia-Pacific Outlook series, Charting New Horizons: 25 Trends Shaping 2025, report below.