As we move into 2025, the Asia-Pacific residential landscape continues to evolve, driven by macroeconomic growth, increasing wealth, and changing consumer preferences. The outlook for high-end residential real estate in the region remains robust, with demand spurred by rapid economic expansion, a growing population of high-net-worth individuals (HNWIs), and the region's increasing prominence in the global luxury market.

Asia-Pacific's high-end residential market surges despite economic challenges

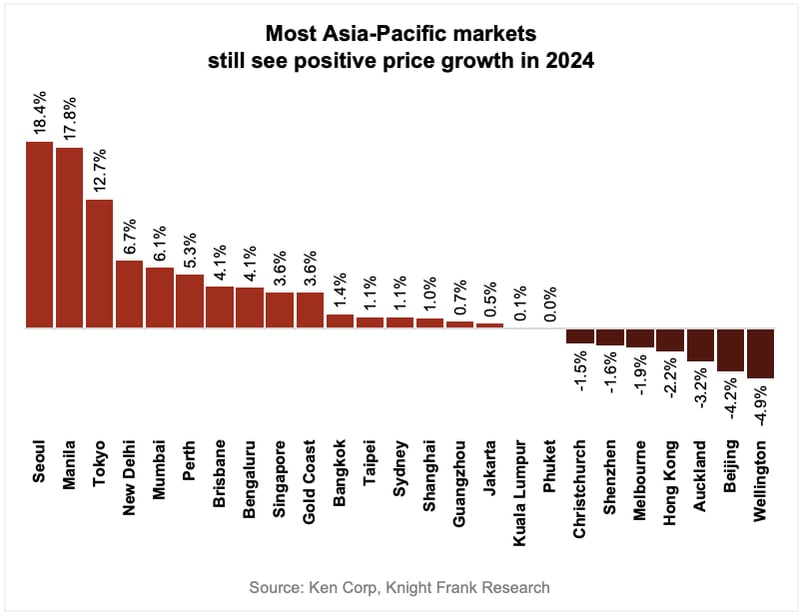

Despite ongoing global economic pressures, demand for prime residential assets in Asia-Pacific remains robust. Building on the upward trend since 2020, average prices in 2024 saw a further 3.1% increase, though at a slower pace than the 3.8% growth recorded in 2023. After four years of exceptional growth, the region's high-end residential market appears to be cooling, but the continued strong demand for premium properties is keeping prices resilient. Among the 25 markets tracked by Knight Frank’s Prime Global Cities Index, 18 recorded stable or positive price growth in 2024.

Manila recorded an impressive 17.8% price growth, driven by strong demand from both foreign and local high-net-worth investors. Similarly, Tokyo saw a remarkable 12.7% growth in prime residential prices, supported by a combination of high stock prices, a depreciated yen, and foreign interest. Additionally, in India, cities like New Delhi and Mumbai saw steady growth, reflecting a rising demand for luxury housing driven by an expanding affluent class. Meanwhile, markets such as those in Greater China faced ongoing challenges, with prime home prices declining on average by 1.3%. This region has struggled with low consumer confidence, hampering recovery in the luxury housing sector.

Looking ahead, the Asia-Pacific prime residential market is expected to stabilise, with projected price growth of 1.5-4.5% across the region in 2025. Driven by improving market confidence, enhancing GDP growth, and infrastructure development, key Asian cities such as Bangkok, Phuket, Manila, and Ho Chi Minh City are anticipated to experience robust price growth in their prime residential markets.

Markets in Southeast Asia, including Jakarta and Kuala Lumpur, may experience more subdued growth due to concerns about supply overhang. However, long-term infrastructure projects and initiatives like Malaysia’s revamped Malaysia My Second Home (MM2H) program could stimulate demand. In Singapore, the luxury apartment market is expected to remain relatively subdued due to cooling measures, but the city-state will still see strategic investment opportunities, especially as the market adjusts to these policies. Across the Pacific, Australia’s housing market is expected to exhibit varying trends, depending largely on the timing of cash rate cuts. Cities like Brisbane, Perth, and Gold Coast are expected to experience close to mid-single-digit price growth, while Sydney and Melbourne may see further corrections. In New Zealand, Auckland is projected to recover slowly, following a significant downturn and price correction.

Emerging trends in 2025: Sustained demand for luxury residential, appeal of branded residences and sustainable luxury

The luxury residential market continues to thrive, propelled by an unprecedented wave of millionaire migration. In 2025, Henley & Partners projects that this trend is expected to reach new heights, with approximately 135,000 millionaires projected to relocate globally. Driven by better tax, living, and investment opportunities, affluent individuals are increasingly relocating to destinations such as Singapore, Australia, and Japan. Prime properties in the region offer considerable value compared to global cities, with Tokyo, for example, offering 64 sqm of prime real estate for US$1 million—almost double what that would buy in cities like New York or London. Many of these wealthy individuals are not only investing in properties for personal use but also as a means of estate planning, securing valuable assets for future generations. This massive movement of wealth is a primary factor driving the continued demand for luxury residential properties, particularly in stable political environments with high standards of living and favorable tax frameworks. In parallel with the growing demand for high-end real estate, the Asia-Pacific luxury residential market is witnessing the rise of branded residences. Branded residences, offering a blend of high-end living and hotel-style services, are experiencing rapid growth, particularly in emerging Southeast Asian markets like Vietnam, Thailand, and the Philippines, supported by strong GDP growth—Vietnam at 6.5% and the Philippines at 6.1% in 2025. This surge is driven by the increasing number of UHNWIs in these countries, as well as in Malaysia and Indonesia, with projections indicating a 45.2% growth by 2028, surpassing the regional average. Additionally, Southeast Asia’s relatively affordable prices compared to Europe and North America make these properties even more attractive. As these markets continue to grow, branded residences are becoming an integral part of the luxury real estate landscape.

Simultaneously, sustainability has become a key priority for luxury homebuyers, with 75% of UHNWIs actively seeking to reduce their carbon footprint partly by prioritising eco-friendly homes according to our Knight Frank Next Gen Survey 2024. Developers are responding by incorporating energy-efficient features, green spaces, and sustainable materials into their projects, as exemplified by Singapore's Wallich Residence, which stands out for its integration of recycled concrete and steel, along with Forest Stewardship Council-certified wood. The project has been recognised for its eco-friendly features, earning both the BCA Green Mark (Gold Plus) and BCA Green Mark (Platinum) awards, demonstrating that successful integration of sustainable practices in construction is achievable. These eco-friendly developments not only support environmental preservation but also provide long-term financial advantages, such as lower utility costs and higher resale values. This convergence of trends - the rise of branded residences, focus on sustainability, and strong price growth in key cities - is reshaping the Asia-Pacific luxury residential landscape, creating new opportunities and challenges for developers and investors alike.

As we look ahead to 2025, the residential real estate market in Asia-Pacific is positioned for continued growth and diversification. From high-end homes in bustling metropolitan hubs to sustainable branded residences in emerging markets, the region is increasingly becoming a global epicenter for luxury living. The demand from UHNWIs, coupled with strong economic growth and evolving consumer preferences, ensures that Asia-Pacific will remain a key player in the global luxury real estate sector, charting new horizons for both investors and residents alike.

For more insights, please download the latest edition of Knight Frank’s Asia-Pacific Outlook series, Charting New Horizons: 25 Trends Shaping 2025, report below.