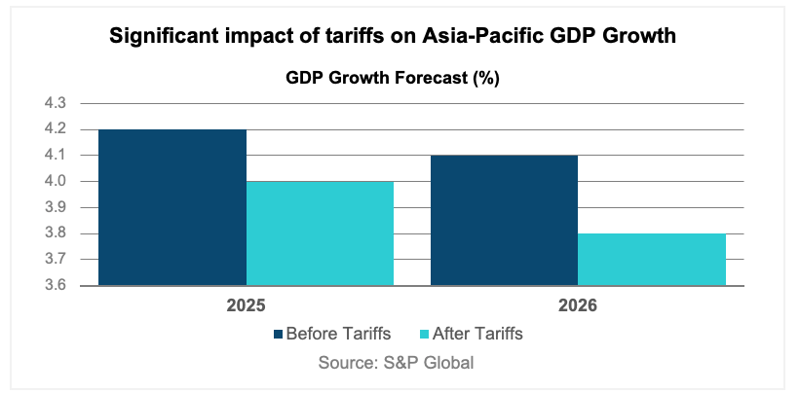

Asia-Pacific finds itself at a crossroads in 2025, facing a complex interplay of economic forces and geopolitical shifts. The return of Donald Trump to the U.S. presidency has introduced a new layer of uncertainty, particularly regarding trade policies and their potential ripple effects across the region.

The Trump factor: reshaping trade dynamics

The spectre of increased tariffs on Chinese exports looms large, with the potential to significantly alter regional trade flows. While the exact magnitude remains uncertain, the impact is likely to be felt most acutely in export-dependent economies and those deeply integrated into regional supply chains.

This shift could prompt a recalibration of trade relationships, potentially accelerating the trend of supply chain diversification that has been underway in recent years. Interestingly, the challenges posed by Trump's policies may inadvertently spur greater economic cooperation within Asia. We may see a renewed push for intra-regional trade links and stronger ties with other economic blocs as countries seek to mitigate risks and reduce dependence on U.S. markets.

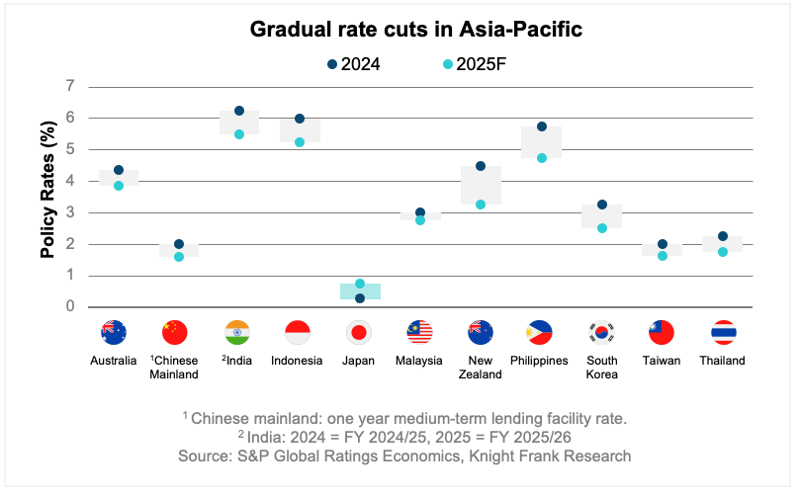

Monetary policy: a delicate balance

The interest rate landscape in Asia-Pacific is expected to trend lower in 2025, with Japan being the notable exception. However, the pace of rate cuts is likely to be more measured than initially anticipated. Central banks in the region are expected to adopt a cautious approach, balancing the need to support economic growth against the potential inflationary pressures stemming from U.S. protectionist policies. This delicate balancing act will require nimble policymaking, with central banks likely to closely monitor global economic indicators and adjust their strategies accordingly. For businesses and investors, this environment underscores the importance of staying attuned to monetary policy shifts and their potential impacts on currency valuations and borrowing costs.

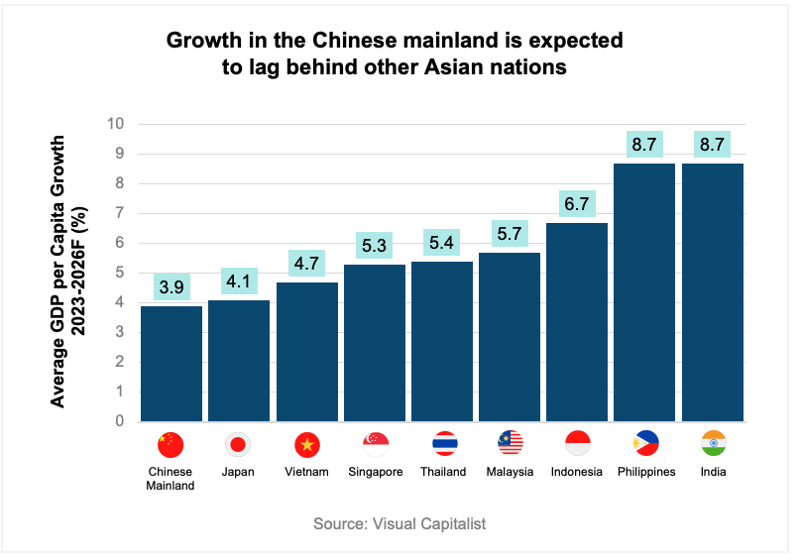

The Chinese mainland: navigating headwinds

The world's second-largest economy continues to grapple with significant challenges as it enters 2025. Weak domestic demand, overcapacity in certain sectors, and ongoing real estate market woes are constraining growth prospects. S&P Global projects the Chinese mainland’s GDP growth to moderate to 4.1% in 2025 and 3.8% in 2026, a marked deceleration from the blistering pace of growth seen in previous decades. In response, authorities are expected to maintain an accommodative monetary stance and ramp up counter-cyclical measures to bolster economic activity. This policy approach will have far-reaching implications not just for the Chinese mainland, but for the broader Asia-Pacific region.

Emerging powerhouses: Southeast Asia and India

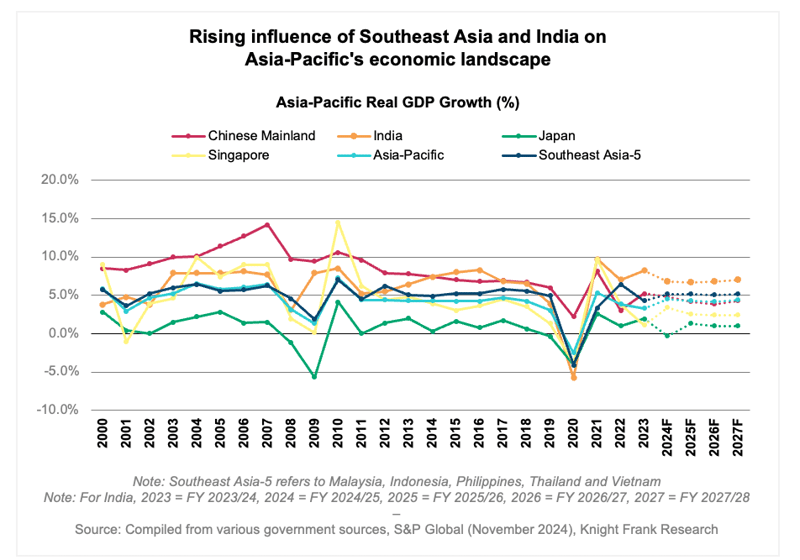

As the Chinese mainland's growth trajectory moderates, other economies in the region are stepping up to fill the gap. The Southeast Asia-5 (Indonesia, Malaysia, the Philippines, Vietnam, and Thailand) and India are increasingly becoming key drivers of regional economic momentum. These countries are benefiting from ongoing supply chain diversification efforts, as manufacturers seek to reduce their reliance on the Chinese mainland. Attractive production costs, improving infrastructure, and skilled labour pools are drawing increased foreign investment to these markets. S&P Global forecasts average annual growth of 5.1% for Southeast Asia-5 and an impressive 6.8% for India over the next three years. This shift in economic gravity within Asia-Pacific presents both opportunities and challenges. For businesses, it underscores the importance of a diversified regional strategy that looks beyond traditional powerhouses to tap into these emerging growth centres.

Japan: charting a unique course

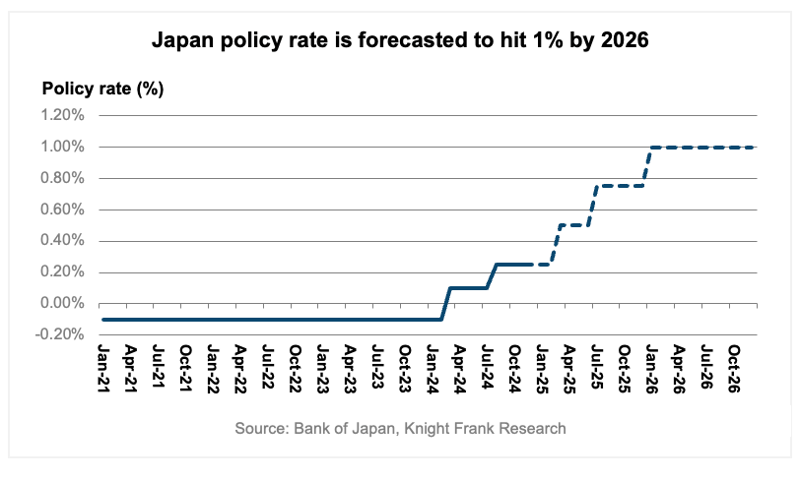

Japan's economic trajectory stands out within the region, with the country poised for further monetary tightening in 2025. Recent data shows core inflation reaching a seven-month high, prompting speculation about additional rate hikes by the Bank of Japan. Market sentiment currently points to a 25-basis point rate hike in March 2025, followed by another similar increase by year-end. This gradual tightening is expected to bring the policy rate to 1.0% by 2026, a significant shift for an economy long accustomed to ultra-low interest rates.

Japan's monetary policy divergence from its regional peers could have interesting implications for capital flows and investment patterns within Asia-Pacific. The country may become an increasingly attractive destination for yield-seeking investors, potentially impacting currency dynamics and asset valuations across the region.

For more insights, please download the latest edition of Knight Frank’s Asia-Pacific Outlook series, Charting New Horizons: 25 Trends Shaping 2025, report below.